When I first started dabbling in sports wagering, I assumed all bets were placed the same way—walk into a shop, hand over cash, and wait for the result. Discovering betting exchanges felt like opening a new door: suddenly I could act as the bookmaker myself. That shift changed how I approach odds, risk management, and even which platforms I choose for my wagers.

What Is a Betting Exchange?

A betting exchange is essentially a peer-to-peer marketplace. Instead of placing a bet against a bookmaker’s set odds, you match your wager directly with other users. You can back an outcome (bet it will happen) or lay it (bet against it). The exchange charges a small commission on winning bets, but it doesn’t build a profit margin into the odds themselves.

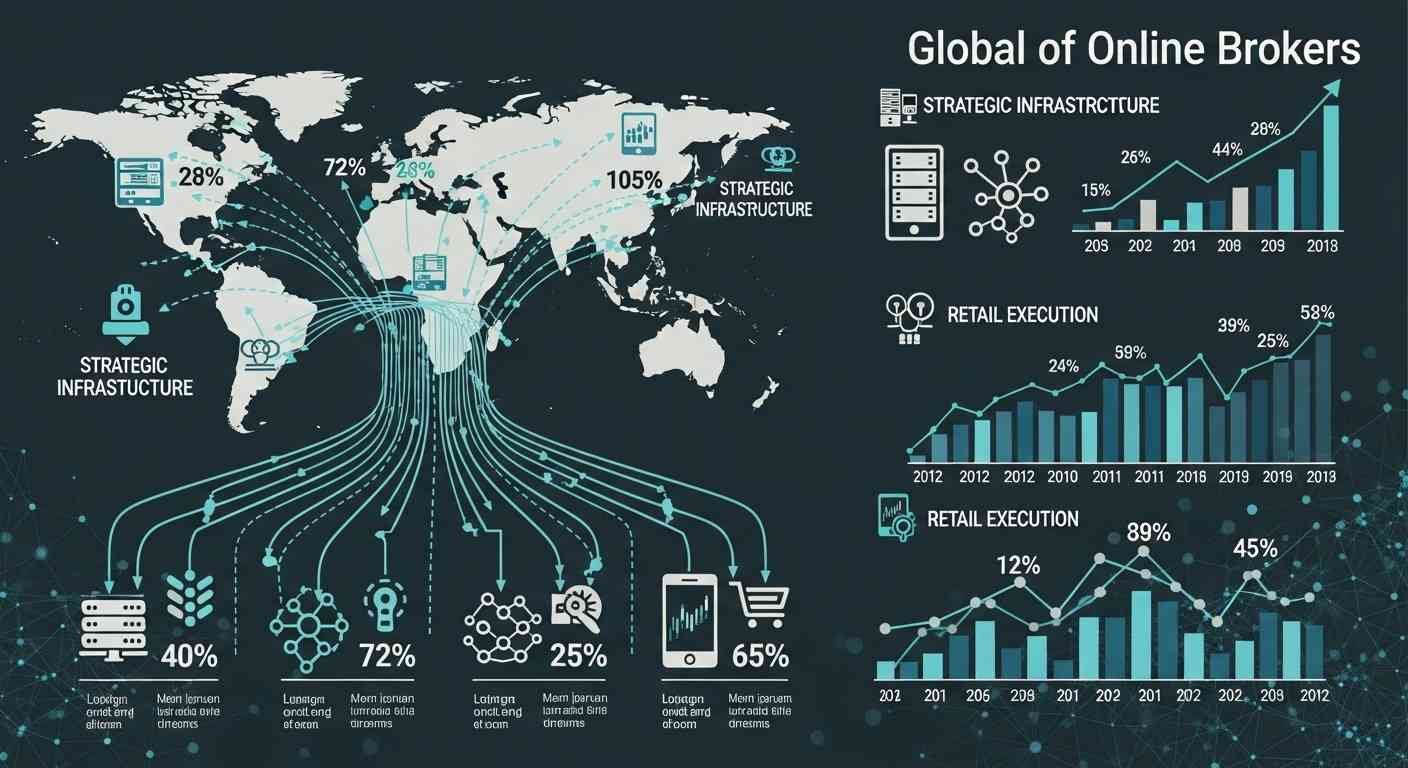

From a technical standpoint, these platforms rely on sophisticated order books and matching algorithms to ensure liquidity. You’ll often see multiple price points, each with available volumes waiting for matching. In my experience, this transparency allowed me to chase slightly better odds—especially on markets like tennis or niche football leagues where traditional bookies might shade margins more heavily.

How Traditional Bookies Operate

Bookmakers take on the risk themselves. They set odds based on statistical models, expert judgment, and market demand, then adjust them to balance their liabilities. This built-in margin—known as the overround—ensures the bookmaker makes money in the long run.

You’ll encounter bookies in physical shops and online on dedicated betting apps uk users are familiar with. Their apps often feature sleek interfaces, cashback offers, and loyalty schemes designed to keep you engaged. But under the hood, every price you see has that house edge baked in.

For a deeper look at the regulatory frameworks and auditing processes that validate these systems, you can explore detailed reports on MDT, which explain how both exchanges and bookmakers undergo rigorous testing to guarantee fairness.

Pricing and Odds Dynamics

In a traditional bookmaker scenario, odds reflect the bookmaker’s view plus a profit margin. They might offer 2.00 (evens) on a football team, translating to an implied probability of 50%, but the true probability might be closer to 52% once you remove their overround.

On an exchange, you might find someone willing to back at 2.02 or lay at 1.98. That small difference can add up over multiple bets. Personally, when I’m hunting for value, I often place multiple lay bets early in the market to secure favourable positions before liquidity thins out. It requires a bit more vigilance and quick execution compared to clicking “place bet” on a bookmaker’s app.

Control and Market Participation

One of the biggest draws of exchanges is autonomy. You decide not only what to back, but sometimes who to lay your bet against. This level of control can feel empowering—but it also carries responsibility. On a bookmaker’s platform, the app handles everything: bet acceptance, liability calculation, and settlement. On an exchange, you need to monitor matched and unmatched bets, adjust your prices, and sometimes even create your own markets in low-turnover events.

Fees, Commission, and Bonuses

Bookmakers make money through the overround, while exchanges charge a commission—typically 2% to 5%—on net winnings. In my early days, I underestimated how those small percentages ate into my profits until I tallied six months of trades and realized commission costs were the second-largest drag on returns after losing bets.

To offset this, many exchanges run rebate programs for high-volume users. Bookies fight back with free bet offers, deposit bonuses, and acca clubs. When comparing the two, factor in both the commissions on exchanges and the bonus wagering requirements on bookmaker sites to determine where you truly get more value.

User Experience and Platform Features

Walking into a shop, you interact with staff, paper tickets, and that unmistakable atmosphere. Online bookies replicate that convenience with polished mobile and desktop interfaces. Many “betting apps uk” favorites include live streaming, in-play cashout options, and integrated statistics—all designed to keep you engaged.

Exchanges tend to attract more seasoned bettors, so their interfaces prioritize live order books, depth charts, and advanced trading tools. If you’re new to markets, that can feel overwhelming. Personally, I started with simple back bets before exploring lay strategies and middle opportunities—where you back high and lay low to guarantee profit if odds swing.

Practical Tips for Choosing Between the Two

Over the years I’ve toggled between bookmakers and exchanges depending on my goals. If I want a quick straight bet on a major match, a bookmaker’s app gets me there fast with minimal hassle. But if I’m trading in-play on a tennis match or arbitraging between markets, exchanges offer the precision I need.

It’s worth opening accounts on both types of platforms. Monitor your average matched odds versus the best available bookmaker prices, then adjust your staking strategy accordingly. Remember to include deposit and withdrawal times, customer support quality, and regional availability in your decision matrix. For example, while many betting apps in the UK process withdrawals instantly, smaller exchanges might take longer to clear large sums.

Conclusion

Betting exchanges and bookmakers each serve distinct roles in the wagering ecosystem. Bookies offer convenience, generous promotions, and intuitive interfaces. Exchanges provide transparency, control, and potentially better odds. By understanding their core differences—how prices are set, how you interact with the market, and what fees apply—you can choose the best tool for your betting style and objectives. Personally, I prefer a hybrid approach: quick bets on the go via apps, and strategic trades on an exchange when I have time to monitor the market. Ultimately, the power lies in selecting the right platform for the right purpose—and wagering responsibly.