Microtransactions have become an everyday part of digital life. From buying in-game items in mobile apps to upgrading experiences in online entertainment platforms, small payments are now embedded in how people interact with technology. In the gambling industry, however, microtransactions take on a more complex role. They can offer convenience, but they also raise concerns about financial control, player behavior, and long-term risks.

Having followed the evolution of online casinos closely, I’ve noticed that while operators frame microtransactions as a way to enhance flexibility, the reality for players can be far more nuanced. Understanding their potential dangers is essential for anyone who spends time or money on digital gambling platforms.

What Are Microtransactions in Gambling?

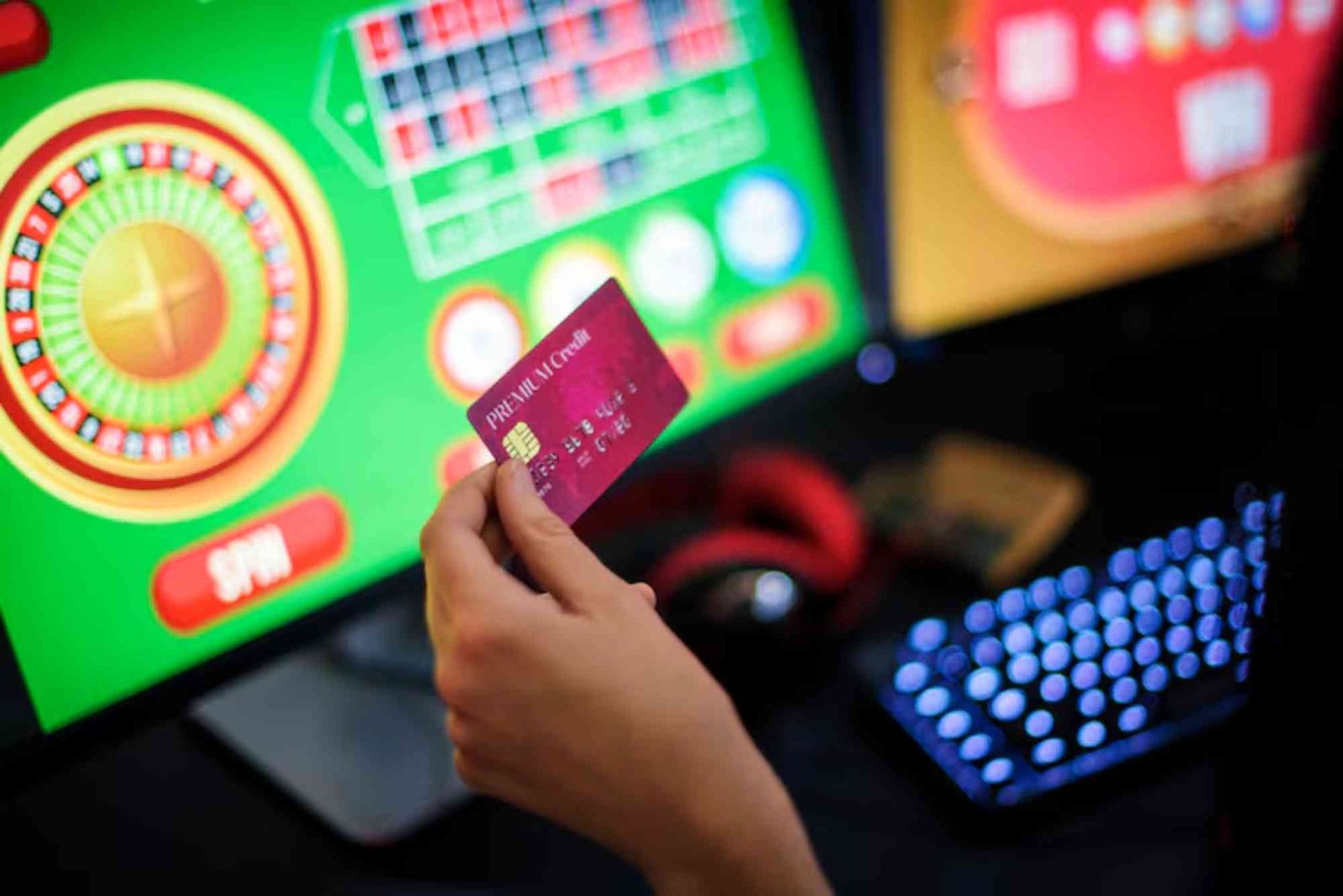

In online gambling, microtransactions usually refer to small, instant payments made within a game or platform. This could be topping up your balance in small increments, paying for extra spins, unlocking special features, or even joining micro-stakes tables.

Unlike traditional deposits that might require players to load larger sums upfront, microtransactions allow continuous spending in much smaller doses. On the surface, this sounds convenient — you can manage your play session without committing too much at once. But psychology plays a big role here. Small payments don’t always feel as significant, and that’s where risks begin to creep in.

For instance, some platforms, particularly casinos not on gamstop, give players more freedom to make such payments without strict oversight. While this may appeal to those seeking flexible gameplay, it can also make it easier to overspend without realizing the cumulative impact.

Why Microtransactions Feel Harmless but Add Up

One of the key issues with microtransactions is their perception. Spending £1.99 on an extra spin or topping up £5 for a quick round doesn’t feel damaging in isolation. Compared to a larger deposit of £100, these micro amounts seem insignificant.

But the very design of gambling platforms encourages repeat spending. Players may rationalize these small outlays as minor, yet dozens of microtransactions over a gaming session can quickly snowball into substantial amounts. It’s the same principle that applies to mobile gaming or subscription add-ons — what feels trivial can end up being costly over time.

Casinos understand this psychology well. By lowering the barrier to entry and encouraging bite-sized payments, they create an environment where spending is easier to justify. Without strong self-regulation, players risk losing track of how much they’ve actually committed.

The Role of Instant Gratification

Microtransactions are tightly linked with the human desire for instant gratification. Gambling already thrives on fast feedback loops: the spin of a slot machine, the turn of a card, or the outcome of a bet. When combined with the ability to make instant payments at the click of a button, the temptation intensifies.

This dynamic can be particularly dangerous for individuals prone to impulsive behavior. Rather than stopping to evaluate their overall spending, they may keep topping up in small increments to chase wins, extend playtime, or recover losses. The convenience of digital payments, while efficient, removes friction that once acted as a natural pause when handling physical money.

Responsible Gambling Concerns

Regulators and responsible gambling advocates often highlight microtransactions as a high-risk feature. The problem lies in how invisible these payments can become. Traditional deposits or cash buy-ins at land-based casinos carry more weight — you physically see the money leave your wallet. In contrast, tapping a button to approve a microtransaction can make the cost feel abstract.

This detachment increases the risk of problem gambling. Some players might underestimate how much they’re spending until they review their bank statement at the end of the month. For vulnerable individuals, this delayed awareness can be financially and emotionally damaging.

How Casinos Benefit From Microtransactions

From a business perspective, microtransactions are incredibly appealing to casinos. They reduce friction in the payment process, encourage more frequent engagement, and help operators capture incremental revenue that players might not have spent otherwise.

In fact, many online platforms have designed their games specifically around this model. Features like extra spins, jackpot boosts, or exclusive side games are all tied to quick, low-cost payments. While this keeps the games exciting, it also turns gambling into a continuous cycle of small purchases rather than a clear deposit-and-play model.

It’s not inherently malicious — casinos are, after all, businesses. But the model relies heavily on player psychology, which is why regulators keep a close eye on how microtransactions are presented and managed.

Balancing Convenience With Risk

To be fair, microtransactions aren’t universally harmful. For disciplined players, they can actually provide more control. Instead of depositing a large sum and risking overspending in one session, microtransactions let them top up gradually and stay within tighter limits.

The key lies in awareness and self-regulation. Players who monitor their spending and set personal limits can benefit from the flexibility without falling into the trap of incremental overspending. Casinos that incorporate strong responsible gaming tools — such as daily caps, spending alerts, and easy-to-access account statements — help create a safer environment for micro-based play.

Lessons From Other Industries

It’s helpful to look at parallels outside gambling. The video game industry, for example, has faced significant backlash over loot boxes and in-game microtransactions. Critics argue these features encourage addictive spending behaviors, particularly among younger players. Regulators in several countries have even moved to restrict or ban certain practices.

Gambling operators would be wise to learn from these lessons. Transparency, fair pricing, and safeguards are crucial in ensuring that microtransactions don’t cross the line into exploitative territory. Otherwise, the industry risks the same wave of public scrutiny and regulatory crackdowns.

The Future of Microtransactions in Gambling

As the gambling industry continues to innovate, microtransactions are unlikely to disappear. If anything, they may become more sophisticated, integrated with mobile apps, loyalty programs, and even cryptocurrency wallets. The challenge will be striking the right balance between convenience and responsibility.

Players need tools to stay in control, and casinos must demonstrate that they can prioritize safety alongside profitability. Regulators will also continue to play a pivotal role, ensuring that microtransactions don’t undermine consumer protection standards.

For players, the lesson is simple: microtransactions can be convenient, but they’re never free of risk. Approached with caution and awareness, they can be part of a balanced gaming experience. Ignored or underestimated, they can quickly turn into a dangerous financial pitfall.

Conclusion

Microtransactions have transformed online gambling by offering flexibility, speed, and constant engagement. But they also blur the line between small harmless spends and cumulative losses that can spiral out of control.

The real danger lies not in the payments themselves, but in how players perceive and manage them. With awareness, responsible gambling tools, and self-imposed limits, microtransactions don’t have to be inherently harmful. However, without these safeguards, they present a subtle yet significant risk that every gambler should understand before clicking “confirm payment” on the next spin or feature upgrade.