The term “instant payday loan” sounds almost magical — apply, click, and the money appears in your account within minutes. For many people facing an unexpected bill or an emergency expense, the idea of immediate access to cash feels like a lifeline. But how instant are these loans really? Do they always deliver funds right away, or is there more behind the marketing?

As someone who’s followed the evolution of short-term lending for years, I’ve seen how the concept of “instant” has changed. While the process is faster than ever before, there are still some essential details every borrower should understand before applying. Let’s explore what actually happens when you apply for an instant payday loan — and how to know if it’s truly the quick solution it claims to be.

What “Instant” Really Means in Payday Lending

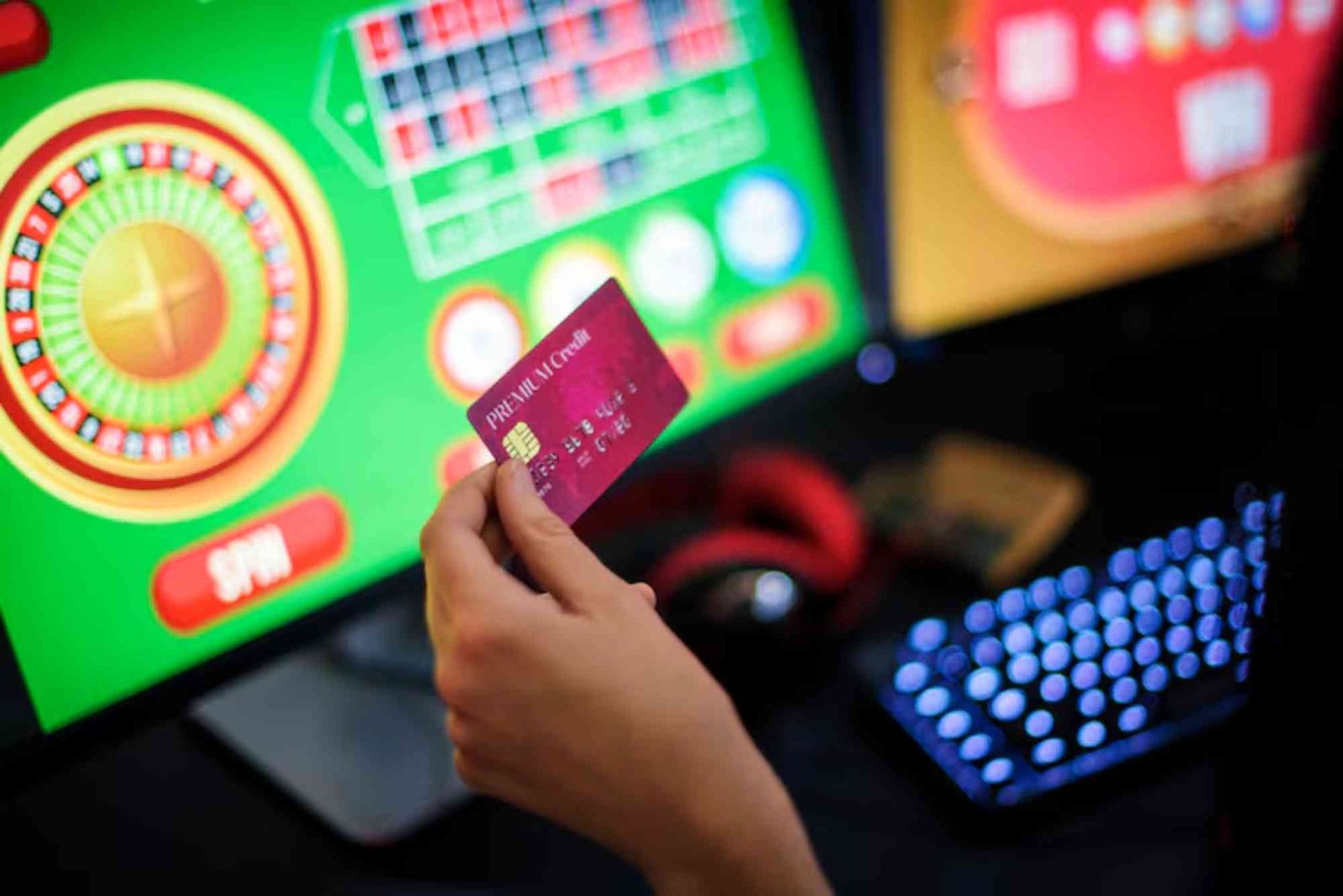

When lenders advertise “instant payday loans,” they’re typically referring to how quickly an application can be approved, not necessarily how fast the money arrives. Modern lending platforms use automated systems that can evaluate your information within seconds.

This rapid approval gives the impression of immediacy, but the transfer of funds still depends on several factors: your bank’s processing times, the time of day you apply, and the lender’s internal systems. In many cases, funds arrive on the same day or within one business day — which is fast, but not always instant in the literal sense.

To get the quickest result, it helps to apply during business hours and ensure that your documents, such as proof of income or identity verification, are ready beforehand. Once the system verifies your data, the payout is often initiated right away.

Many UK borrowers compare lenders to find faster payouts and more transparent terms. Websites that feature options for best payday loans uk often highlight lenders known for near-instant transfers and fair eligibility checks. These platforms can be a useful starting point when you’re unsure which provider can genuinely deliver the speed you need.

How Lenders Process Instant Payday Loan Applications

The biggest reason payday loans can be approved so quickly is automation. Traditional banks rely on manual reviews, credit checks, and layers of bureaucracy that can take days. Payday lenders, by contrast, use algorithms that assess key data points instantly — your income, employment stability, spending habits, and repayment history.

Once the algorithm determines you meet the basic criteria, the system automatically generates a loan offer. If you accept, the funds are transferred electronically. Some lenders use Faster Payments, which means you could see money in your account within minutes, while others still rely on standard bank transfers.

It’s worth noting that “instant” does not mean guaranteed. If your information can’t be verified automatically — for example, if your employment details don’t match or your bank delays the payment — processing could take longer. The key advantage, however, is that payday lenders generally operate with fewer delays than traditional financial institutions.

The Real Speed of Payday Loans

From a practical standpoint, most payday loans that advertise as “instant” will reach your account within a few hours, but not always in real time. A few lenders have managed to bridge this gap by integrating directly with banking APIs, which allows them to disburse funds instantly after approval.

However, such true instant transfers usually apply to smaller amounts and existing customers whose details are already verified. For first-time borrowers, verification checks remain necessary — and that can add anywhere from 15 minutes to several hours.

For example, if you apply for a payday loan at 9 a.m. on a weekday and your lender uses the Faster Payments system, you might have the funds before lunchtime. If you apply after 5 p.m., your transaction may not clear until the next working day. It’s all about timing and the systems each lender uses behind the scenes.

Common Misconceptions About Instant Payday Loans

One of the biggest myths around payday loans is that they’re available 24/7 with immediate access to funds. While many websites accept applications around the clock, the actual money transfer depends on bank operating hours. Few lenders can release payments outside normal banking windows.

Another misconception is that “instant” equals “no credit checks.” Even fast lenders must comply with responsible lending regulations. While they may perform soft credit checks that don’t affect your credit score, they still assess affordability before approving a loan. This helps ensure borrowers can repay on time and reduces the risk of financial strain.

Also, “instant approval” doesn’t mean “instant cash.” Some people receive confirmation within minutes but still wait several hours for the deposit. Transparency from the lender’s side makes all the difference — reputable providers clearly state their processing times upfront.

The Pros and Cons of Instant Payday Loans

The main advantage of an instant payday loan is accessibility. If your car breaks down, your rent is due, or an unexpected medical bill arrives, you can apply online and receive money much faster than through traditional credit channels.

Another benefit is flexibility. Many lenders accept applications from people with imperfect credit histories, focusing instead on income and repayment capacity. For short-term emergencies, this can be a practical solution.

However, the speed of approval doesn’t eliminate the risks. Payday loans often come with high interest rates, making them expensive if not repaid on time. Borrowers should always treat them as a short-term fix, not a long-term financial strategy. Using them repeatedly to cover ongoing expenses can lead to a cycle of debt that’s difficult to escape.

How to Choose a Reliable Lender

Not all payday lenders operate the same way, and speed should never come at the cost of trust. Always check that a lender is authorized and regulated by the Financial Conduct Authority (FCA). Licensed lenders must display their FCA registration number on their website.

It’s also worth reading reviews and confirming the transparency of repayment terms. Reliable lenders clearly outline fees, interest rates, and total repayment costs before you sign. Avoid providers that advertise “guaranteed approval” — this is a red flag for irresponsible or even predatory lending practices.

When comparing options, look for lenders that offer both speed and fair repayment conditions. It’s better to receive funds in a few hours from a reputable company than in minutes from an unregulated one.

Final Thoughts: Instant, But Not Always Immediate

So, are instant payday loans truly instant? In most cases, they’re fast, but not immediate. Approval decisions may be automated, but banking networks, verification steps, and lender policies all affect how quickly the money reaches you.

That said, compared to traditional loans, payday lending remains one of the fastest ways to access emergency cash. The key is to approach it responsibly — understanding both the speed and the cost involved.

If you ever find yourself in a financial bind, an instant payday loan can provide breathing room. Just make sure to borrow only what you need, choose licensed lenders, and repay promptly to avoid unnecessary interest or penalties. In financial matters, speed is valuable, but stability and responsibility matter even more.